- The financial crisis of 2008 led to a spike in the number of credit defaults, mostly in the developed world. As a result, almost all banks (largely from the US and Europe) saw an increase in the quantum of non-performing loans, adversely impacting their profitability and hurting the overall economy. To overcome these challenges and repair the banking system, the following steps were initiated:

- Central Banks / Governments adopted expansionary monetary / fiscal measures to boost economies and prevent banks from making losses and fail

- Stricter regulations were also passed to ensure compliance (Dodd–Frank Wall Street Reform and Consumer Protection Act were the main rulings).

These measures paid off as most banks (largely in the US) witnessed a decrease in delinquencies in the recent years. Some of them are even performing better with non-performing loans (as a proportion of total loans) being more favorable vis-à-vis pre-crisis era. However, these benefits came at the expense of lower profitability (lower net interest margins primarily owing to low policy rates) with added complexity (increase in compliance costs). Plus, more than 40 percent of US 1 banks are still lagging the pre-crisis era in terms of high risk default loans. Further, Fed tapering should cause policy rates to rise and subsequently, nonperforming assets may increase in the US. The situation is even worse in Europe, with deflation and sluggish economic growth amplifying the risks further. Apart from these risks and complexities, banks need to sort out the data acquisition hurdles and data inaccuracies. These call for a strong credit appraisal process with reduced costs to ensure lower defaults and enhanced profitability.

This article addresses how banks can strengthen their credit appraisal process so that default risks are minimized. Should they stick to conventional methods or should they drive step-changes to their conventional processes that assure greater accuracy, reduced costs and enhanced profits?

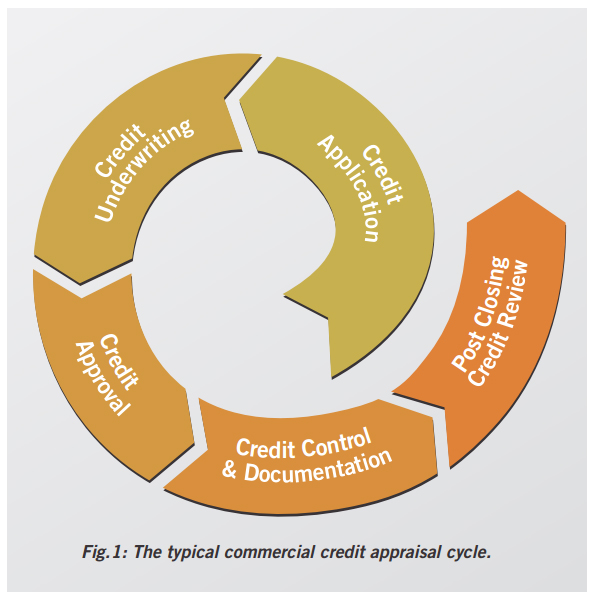

What's Putting a Spanner in the Works in the Commercial Credit Appraisal Cycle?

Operational challenges that tend to put a spanner in the works for commercial banks in the US can be categorized under three heads:p

- Unavailability of customer information

- Data inaccuracies

- Uncontrollable delays in credit approvals

We take a closer look at how each step in the cycle gets impacted by these challenges.

- Credit Application: Incomplete documentation and limited availability of public information tend to influence not just the turnaround time for disbursal but also raises the risk of delinquencies

- Credit Underwriting: Financial 'spreading', a key aspect of credit underwriting, involves re-creating financial statements on a spreadsheet and making forecasts based on future financial statements using percentages. Every financial statement, be it the income statement (based on a percentage of revenues / total sales) or the balance sheet (based on a percentage of total assets), is spread differently, making this an intricate step for commercial banks.

The documents required for 'spreading' are usually received by the bank from multiple sources and in different formats, forcing analysts to enter the data manually into the spreading system. This in turn leads to:

- Data incompatibility and inaccuracy: Data coming to banks from multiple sources are incompatible with each other and with the standard credit analysis softwares. Tedious manual tasks like retyping or 'cutting and pasting' are the only ways to transfer this data from its original format to its destined format. These types of manual processes are not just expensive and slow, but are also inherently error-prone

- High costs: The exorbitant cost of assimilating and collating company information restricts the scope and frequency of the credit appraisal process

- Credit Approval: Very often, unavailability of sufficient information leads to delay in the multilevel approval cycle that appraises details related to the purpose of the loan, credit documentation, determining the loan structure, making recommendations on the loan product, and checking the repayment capacity of the company

- Credit Control and Documentation: Banks depend on client financial statements and other disclosures to assess whether borrowers are in violation of covenant ratios. The high costs associated with information gathering and consolidation prompt banks to forego compliance assessments, leading to compromises in compliance monitoring Above and beyond operational complexities, banks and credit unions are grappling with an increasing number of regulations. The Qualified Mortgage rule, the Dodd-Frank Act, the Truth in Lending Act, the Real Estate Settlement Procedures Act, the Fair Credit Reporting Act … the list of regulations that U.S. lenders have to comply with, is getting longer. A large percentage of bankers and credit unions engaged in commercial lending, consider regulations and compliance as their topmost business challenge. Three step-changes can effectively solve some of the central challenges in the commercial credit appraisal cycle and give it a new lease

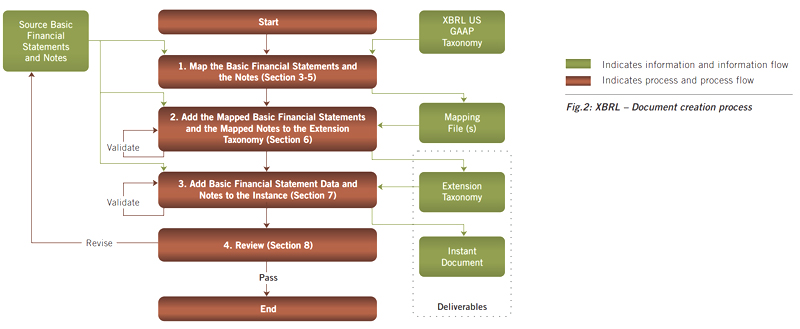

Step 1. Moving from Manual Interventions to Automation and XBRL

The complexities around data acquisition can be simplified to a large extent by opting for automation over manual processes. The effective deployment of automation — specifically, document exchange protocols and standards — OCR technologies and markup language applications, particularly XBRL can truly transform the credit appraisal process.

XBRL, a technology standard based on Extensible Mark-up Language (XML) uses metadata to provide context (labels, definitions and references) to financial information for creators as well as users of the data. It makes financial information portable and readable, and easier to extract and analyze. Included in the 'HBR List: Breakthrough Ideas for 2007', XBRL makes it significantly easier to generate, validate, aggregate, and analyze business and financial information. XBRL enhances the accuracy, reliability and availability of data for users.

In August 2008, the Securities and Exchange Commission (SEC) proposed a road map for the adoption of International Financial Reporting Standards (IFRS). XBRL compliance enables dissemination of financial information through a coding system.

XBRL requires an enterprise mindset that transcends regulatory compliance. It realizes the benefits of streamlining processes, risk mitigation and corporate governance. Perhaps, the single biggest motivation for banks to gravitate towards XBRL is increased process transparency and internal reporting.

This step-change has the potential to enhance accuracy, reliability and availability of customer data.

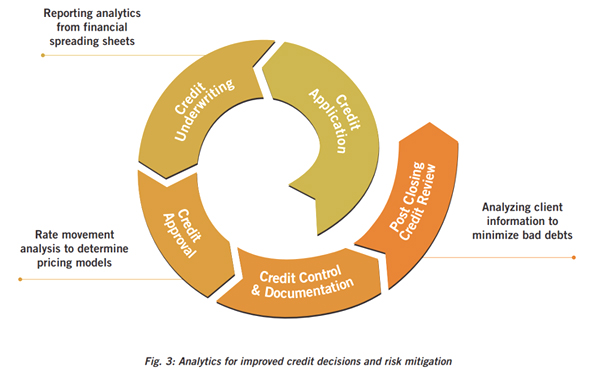

Step 2: Deploying Analytics for Improved Credit Decisions and Risk Mitigation

Credit analysis has been an integral part of the credit appraisal process as it involves decisions that have a direct impact on the bottom-line of the business. With frauds taking on very sophisticated forms, relying on the traditional means to assess and mitigate risks from bad debts is no longer a prudent choice. This is where a dependable MIS and robust analytical models come to the aid of banks and help them make informed decisions on limit setting, risk management, budgeting and assessing propensity to default.

Analytical models can be effectively deployed at multiple levels of the credit appraisal cycle. Reporting analytics from financial spreading sheets of potential borrowers can equip the bank to arrive at accurate risk ratings thereby reducing the risk of delinquencies. Additionally, by tracking and analyzing rate movements, banks can effectively design interest rates and pricing models. Even after the loan has been disbursed, banks can continue to keep a tab on borrowers and minimize the risk of bad debts by analyzing client information on financials, business and industry performance.

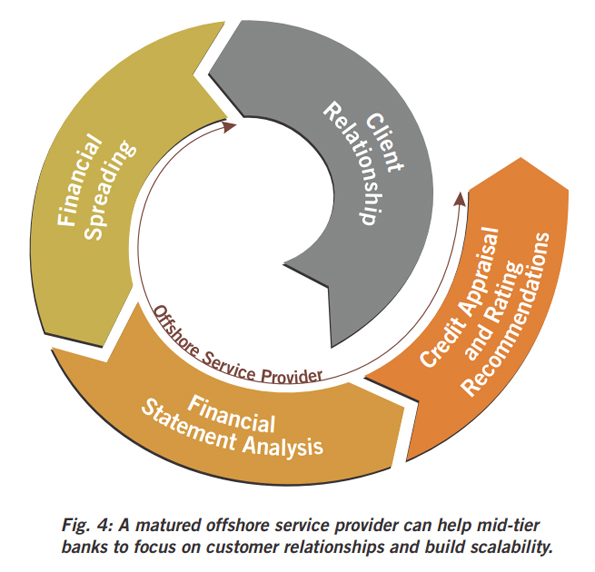

Step 3: Engaging with a Mature Offshore Service Provider for Overall Process Enhancements, Increased Accuracies and Improved Decision-making

Managing the credit appraisal process end-to-end, single-handedly, puts added pressure on banks, especially the mid-sized ones, in terms of resources, infrastructure and costs, besides leading to errors in data acquisition and at times, results in compromises in regulatory compliance. Outsourcing parts or whole of the credit appraisal process has emerged as a great option of choice for mid-tier banks and financial institutions offering commercial credit.

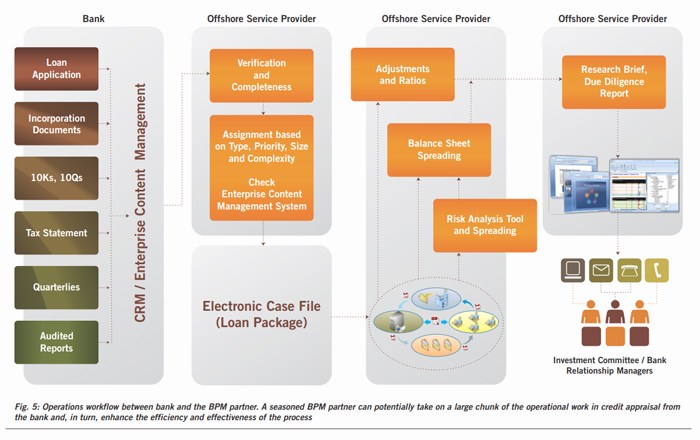

A mature offshore service provider (with a comprehensive industry knowledge base, automation and technology platforms and analytical capabilities) can effectively take on key aspects of the credit appraisal process such as financial spreading, financial statement analysis, credit appraisal and rating recommendations, freeing up the bank to focus on customer relationships and build scalability.

When banks partner with a mature offshore service provider, they can expect to see changes at multiple levels.

Process enhancements:

Commercial banks, especially the mid-tier ones, often struggle with the unavailability of 'spreading' guidelines, lack of knowledge in specific property types, fluctuations in complexity levels in spreading, and lack of standardization and document management solutions. Offshore service providers with domain knowledge of commercial credit appraisal and the capability to introduce best practices and standardization mechanisms can bring about significant improvements in the overall process.

Tech-enabled accuracy, reliability and availability of customer data:

Banks looking at simplifying the credit appraisal process with the help of automation and XBRL are often discouraged by the costs and complexities involved. However, they can leverage technology platforms and XBRL domain specialists to meet their objectives without straining their own resources by partnering with an offshore service provider.

Illegibility of the statements, especially the company prepared statements, is a commonly encountered problem in the credit appraisal process. Many offshore providers have invested in technology solutions that help to integrate / aggregate the input documentation and also support data analytics and MIS reporting. Moreover, given the quantum and complexities of major financial reporting taxonomies such as US GAAP, it is advisable to partner with an XBRL outsourcing specialist to select the most appropriate XBRL software and select the components of XBRL implementation such as project management, XBRL creation and tagging.

Data tagging is a process that involves mapping XBRL taxonomy with financial reporting data to locate concepts equivalent to attributes of a data point within the taxonomy structure. It is a complex process that requires accounting knowledge and judgment of financial reporting specialists and offshore providers with XBRL specialization can effectively help banks with XBRL compliance and enhance the accuracy and reliability of the credit appraisal process.

Informed decision-making:

Mature offshore providers specializing in commercial credit appraisal usually have analytical capabilities to support decisions within a large part of the credit matrix. Offshore service providers can actively support banks with analyzing client profiles and generating risk ratings, designing pricing models, and helping minimize the risk of bad debts.

WNS – An Experienced Offshore Service Provider of Advanced Credit Appraisal Solutions

WNS is a leading global Business Process Management (BPM) company. As a provider of end-to-end commercial banking services, WNS has been lending its support to clients in trade finance, credit risk management, cash management, commercial lending and treasury services.

Our robust credit processing capabilities enable us to process more than 110,000 credit applications, and manage financial spreading of over 90,000 financial statements for more than 13,000 end-customers on an average, for global, regional and investment banks.

We engage with clients to provide document and collateral management support, credit analytics, risk management, and audit and compliance support processes. We have vast experience in leveraging industry-leading analytics platforms such as Cognos, Omniture, Oracle Business Intelligence, MicroStrategy, BusinessObjects, Responsys and Minitab, to drive actionable insights for clients. For the commercial credit business, our focus has been on scenario analysis based on macro-economic indicators, business and industry parameters and assessing their impact on company P&L, thereby helping clients improve credit decisions.