The Market Research Paradox

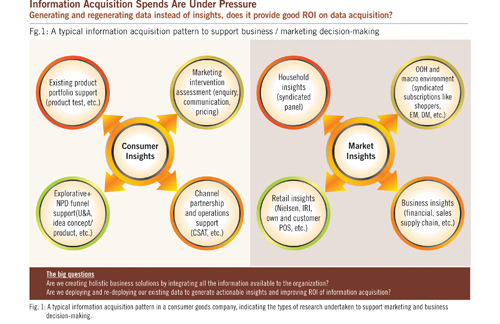

For the marketer, key marketing decisions related to product, pricing, distribution and promotion are based on market research data that provides insights into consumer behaviors and attitudes. Market research has been often considered the foundation of marketing decisions. However, thanks to economic volatility, globalization, boom in digital media and social networks market research today occupies a paradoxical position. On the one hand, market research forms the very core of developing marketing strategy by getting a view of consumer needs, requirements and behaviour; and on the other, it requires significant investment commitment.

Market research is one aspect that the CMO can neither do without, nor ignore!

Despite the need for consumer and market insights, the decision to initiate new market research projects has come under the scanner of late and the decision to commission new projects is being approached with a lot of caution

Conducting market research is an expensive proposition and companies in the current economic climate are finding it difficult to set aside budgets for it. For example, the cost of central location testing (CLT) has risen by 20 percent, compared to 2010 and the cost for telephone interviews have gone up by 10 percent (ESOMAR 2012 Global Prices Study, October 2012). Face-to-face research is the most expensive method – that costs almost twice the amount spent on online research. The ESSOMAR report finds that the United States is the most expensive country in the world for market research.

High cost is not the only factor that’s slowing down organizational decisions to initiate market research. Today, questions are being raised on the utility value of market research as well. The perception that research is more of a hindrance than guidance for marketing decision making, is becoming stronger. This perception finds its roots in the inability of research studies / initiatives to answer business / marketing problems in totality.

Consumer & Market Insights … and beyond with Research Re-use

The marketer has to justify every penny spent and ensure that sufficient ROI is generated out of every marketing effort. Besides, he also has to establish the utility and efficiency of research studies in generating important business insights. The question that often troubles today’s marketer is: do you really need to commission a new research, every time you need consumer insights?

While a majority of marketers may say ‘yes’, the reality is that each time a ‘new’ research is commissioned, there are overlaps in the data generated from the new research and the data that is ready and available from previous research projects.

Existing research data is a ‘goldmine’ that presents a big opportunity for marketers. Re-using existing research data can equip marketers with insightful information for making decisions in a faster and cost-efficient manner in comparison to commissioning a new research, each time there is a need to get a peek into consumer behavior and demands. The trend is gradually shifting from collecting new data (via questioning) to analyzing abundantly available data (via observing or listening) to see new patterns, clusters and inter-relationships.

A growing number of smart marketers are focusing on existing data to derive fresh insights and there are predictions that by 2020, 80 percent of research projects are expected to begin by mining existing data as opposed to starting afresh (The Future of Research Report: Cambiar, 2011).

The benefit of research re-use translates into enhancement in ROI of data acquisition at three levels:

Making a New Beginning with Research Re-use – But is your Data ‘Re-use ready’?

Despite the possibilities research re-use presents, challenges in the process of data mining can turn out to be quite a dampener. Data from previous research projects is highly variable and usually lies in silos across multiple geographies, different research studies and multiple research partners. A result of this variability in the form and source of the data, often leads to oversights on the kind of information available to the marketing department. This ‘passive relationship’ between the marketing department and the research data, acts as a roadblock in re-using existing research accurately to chalk out the precise marketing strategy.

It is therefore important for organizations to take charge of this data (by accessing it and taming it) from their research partners / agencies in order to:

- Enable innovation analytics to drive high quality decision-making

- Enable faster predictions about business outcomes

- Enhance RoI on research spends

Integrating or effectively utilizing data from different sources to answer business problems is what the industry needs today. However, only a miniscule proportion of industry players have reached a maturity level and are able to extract a ‘holistic’ answer or direction from multiple data sources such as brand tracking, usage and attitude, syndicated information sources and so on.

Adopt the 5-step Strategy to make your Research Data Talk

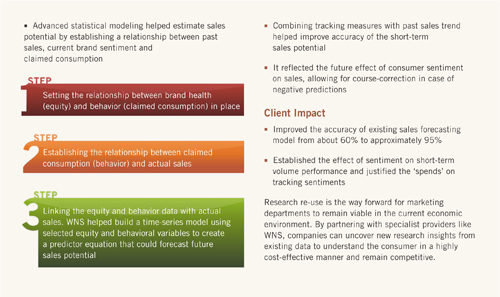

WNS, a global business process management company, with strong domain-expertise in research and analytics and the owner of the award-winning, proprietary analytics framework, WNS Analytics Decision Engine (WADESM ), employs and recommends the 5-step strategy (backed by WADESM) to extract enhanced value from existing research.

Step 1: Research Re-use – The first step is to source the respondent level data from the company’s research partner / agency, understanding which data sources to integrate and running analytics models to derive actionable insights. For instance, in the packaged goods industry, WNS uses shopper studies, brand tracking research, attitude & motivation studies and integrates the resultant data with advertising spend data, media data and economic data.

Step 2: Harmonize & Design – Since research data is highly scattered and variable, it is important to organize the data into a knowledge bank that makes analysis easy and hassle free. WADE SM effectively organizes data from multiple geographies and a variety of research studies.

Step 3: Data Access – At the heart of WADESM is Harmoni – a tool designed for researchers by researchers – which gives companies the power to mine existing data repeatedly, eliminating information wastage and thereby saving costs. It provides the ideal platform to explore marketing data and discover new relationships.

Step 4: Innovation Analytics – The first three steps is succeeded by the innovation analytics step, wherein all the target data is processed by WADESM , enabling organizations to scale analytical maturity and become fact-based in thinking and achieve long-term growth.

Step 5: Insights Exchange - WADESM gives companies absolute control over existing research data to unearth hidden insights. With these tools at hand, organizations can extract meaningful insights from data that often lies under-utilized in silos.