The European Union, in response to the banking crisis, has made it mandatory for insurance companies to increase their capital reserves. According to a study by SMB Research, U.K. non-life insurers face an average Solvency Capital Requirement (SCR) increase of 62 percent compared to the Solvency II QIS4 standard formula level, as a result of changes proposed to the implementation measures for the European regulatory standard over the past six months.

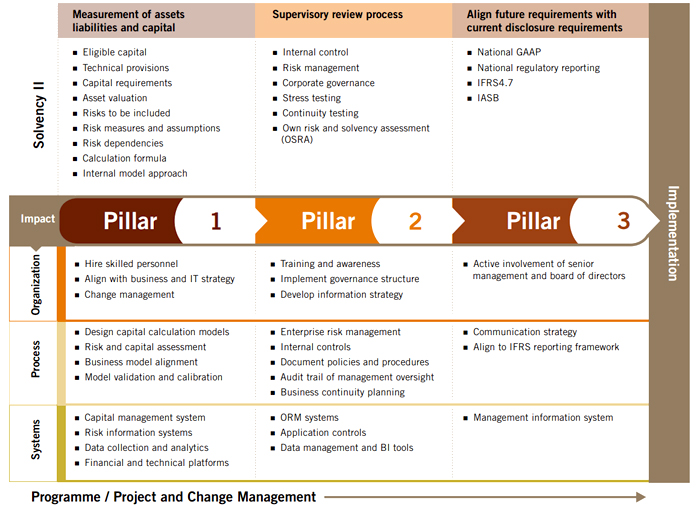

According to a recent report by PricewaterhouseCoopers, titled ‘Solvency II: Impact on organization, processes and systems’ organizations will need to re-invest in processes, systems and people in the face of the new regulatory requirements. The table below gives an idea of what this would entail:

As Solvency II laws continue to tighten their grip in Europe, the small and medium sized insurers will be under pressure. While the intent of Solvency II is to establish a more robust and competitive EU insurance market, the demands of increased regulatory compliance, corporate governance and capital reserves have meant that smaller insurance players struggle to maintain operational efficiencies and reasonable profit margins.

However, if approached in a strategic manner, smaller insurance companies can identify synergies between business needs and compliance requirements to drive business efficiency opportunities and can thereby turn their challenges into opportunities. Strategic alliances with outsourcing service providers can help address the pressures of regulatory challenges as well as enable efficiencies of scale.

One of the first challenges facing smaller insurance players is data collection and management. Understanding the quality and availability of existing information is key to a successful Solvency II implementation. Most risk measurement information comes through policy administration, claims management and asset management. Also, in this changed scenario, companies need to know more about customers. Robust internal controls at each stage of data processing are critical to get reliable information. The business benefit of this exercise can be enhanced customer service quality as well. A strong offshore team can help the smaller players in gathering and maintaining data as well as supporting their customer service requirements.

The second challenge is analyzing data and building sustainable and comprehensive risk management models. The risk management framework should include the policies and procedures that lay down key risk indicators, the limits and the responsibilities for setting the limits, and acting on the indicators. These exercises should run at quarterly periodic intervals and require both technical as well as subject matter expertise. Outsourcing providers possess the necessary talent as well as systems for risk management. Smaller insurers can get together to leverage the expertise and services of the outsourcing providers. This could extend to using an outsourcer’s processing power when running analytical models, rather than buying the technology internally and only deploying it periodically through the year.

Outsourcing companies can also provide smaller insurers access to full fledged actuarial teams which can help companies in understanding the risks in the business plan and sensitivities to key assumptions, and how this fits with the firm’s risk appetite. They can further help assess the possible impact that various strategies of the company can have on the risks and capital of the business.

Working with outsourcing providers who have a strong capability in insurance, insurance companies can identify and implement initiatives that will improve their business performance. They can determine and improve pricing structures and optimize capital allocation across business lines.

Furthermore, smaller companies can use the data analysis and risk assessment models to employ more focused risk management techniques in niche product areas. A key challenge posed by Basel II regulations for these insurers has been the lack of sufficiently skilled manpower to run risk management programs. Outsourcing helps address that gap for insurers and provides them the opportunity to turn their fears into profitable opportunities.